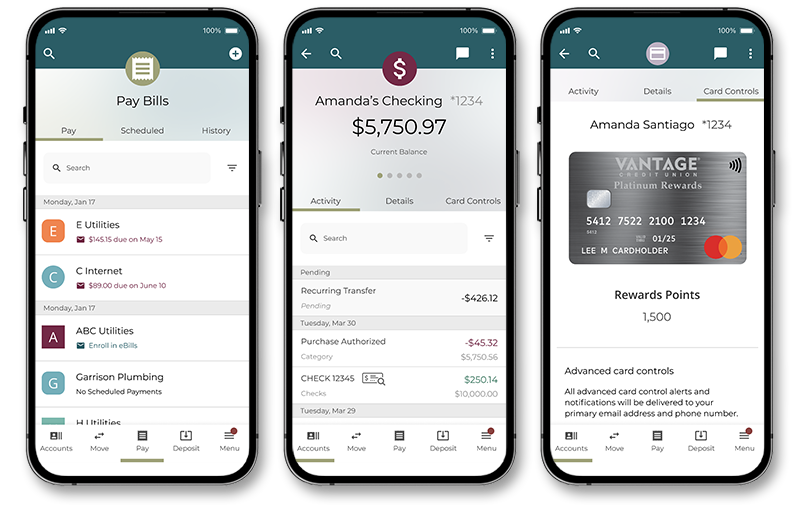

Vantage Digital Banking

— Your finances at your fingertips.

Your life is on the go. With the new Vantage digital banking platform, whether you’re at home, at work or on the road, Vantage is there for you 24 hours a day, 7 days a week. You decide when and how to interact with us, with new and intuitive features to best serve your financial needs.

Experience features you already know and use—plus new ones to help you achieve more!

New dashboard

New, intuitive dashboard to review recent transactions, balances and personalized recommendations all in one view.

My credit score

View your weekly credit score and predict how adding a loan could impact it.

Savings goals

Create goals to help you save for an emergency, vacation, education expenses or more, plus monitor your progress.

Financial health checkup

See your spending analysist by category, forecast future spending and add external accounts to keep track of all your accounts in one place.

Card controls

Manage your credit and debit cards with the ability to turn cards on and off, block certain transactions, designate approved regions and set spending limits.

Account alerts

Receive real-time notifications for information you want to know, such as balance alerts, when a check clears or a loan payment is due.

Download our digital banking app today!

Finances at your fingertips. Our digital banking platform is loaded with easy-to-use features to support your financial needs—anytime, anywhere.

First Time Sign In

Recover Username or Password

Set Up Account Alerts

Customize Card Controls

Frequently Asked Questions

Make sure that you’ve tapped Request Code. You should receive your code within a minute, but if you don’t, consult these tips:

- You may have to contact your carrier to enable short codes on your device.

- Check that your number on file is correct.

A CD (certificate of deposit)* is a time deposit, a financial product commonly offered to consumers by financial institutions. Typically, CDs are insured by the NCUA for credit unions and the FDIC for banks. When insured, CDs are similar to savings accounts in that they carry less risk than equities. They are different from savings accounts in that the CD has a specific, fixed term, and usually, a fixed interest rate. It’s intended that the CD be held until maturity, at which time the money may be withdrawn together with the accrued interest. In exchange for keeping the money on deposit for the agreed-upon term, institutions usually grant higher interest rates than they do on other interest-bearing deposit accounts from which money may be withdrawn on demand. Fixed rates are common, but some financial institutions offer CDs with various forms of variable rates, like our own 36-month Step-Up CD option.

*CDs offered through financial institutions offer a fixed rate of return if held to maturity, whereas the return and principal value of an investment in equities fluctuates with changes in market conditions.

Please access your CURewards account through digital banking for rules regarding points usage and expiration.

Interest rates fluctuate based on a variety of factors, including inflation, the pace of economic growth, and Federal Reserve policy. Over time, inflation has the largest influence on the level of interest rates. A modest rate of inflation will almost always lead to low interest rates, while concerns about rising inflation normally cause interest rates to increase. Our nation’s central bank, the Federal Reserve, implements policies designed to manage inflation and interest rates.

Vantage members can use any of our ATMs for free! Our fee for non-members to use our ATMs is $3.00 per transaction. Please note that other fees may apply for any non-Vantage member using our ATM.

You can add checking and savings accounts you have with other financial institutions under Make A Transfer > External Accounts. Once you’ve linked external accounts, you’ll be able to use them to pay loans and make transfers to your checking and savings accounts.

Log in to digital banking, select your card from the Accounts screen and navigate to Card Services. Follow the Redeem link to go to the CURewards website. From the CURewards home page, choose Redeem from the tool bar and select Merchandise, Travel, or More. You can select from a variety of electronics, home and sporting goods, and personal items; purchase flights, hotels, and rental cars; request a cash deposit to your checking account or payment to your Vantage credit card; and more.

Yes, you can look at your accounts and transactions on your Apple Watch when you’re logged in to the Vantage mobile app.

Vantage Credit Union charges $2.00 per transaction, including balance inquiries, at non-Vantage ATMs. These ATMs owned by other financial institutions may also charge a surcharge fee that could range anywhere from $1.50 to $10.00 or more, depending on the ATM owner. Please note that the surcharge is NOT charged by Vantage Credit Union, but by the ATM owner. You can avoid paying the $2.00 per transaction fee, as well as surcharges fees, by using a Vantage ATM or an ATM bearing the CO-OP Network logo. There are nearly 30,000 CO-OP Network ATMs nationwide. Find a surcharge-free ATM near you.

Yes. For your convenience, you can change your debit card PIN by phone 24 hours a day, 7 days a week. You’ll need your sixteen-digit card number, the last four digits of your Social Security Number, the three-digit security code next to the signature panel on the back of your card, and the four-digit expiration date on the front of the card.

Cardholders with a U.S. phone number will need to call 866.985.2273 and follow the prompts.

Cardholders with an international phone number will need to call 531.262.5314 and follow the prompts.

Yes, the fee for a lost or damaged card is $10.00. There is no fee for a card that has been stolen.

While ATM deposits are credited to your account at the time your deposit is made, the funds may not be immediately available for use subject to our Funds Availability Policy.

Since January 2012, U.S. savings bonds and other government securities can only be purchased electronically through TreasuryDirect. They’re no longer available over-the-counter at financial institutions.

TreasuryDirect is your one-stop shop for all U.S. Treasury Securities, including: Series I and EE Savings Bonds, Treasury bills, notes and bonds, Inflation-Protected Securities (TIPS), and Floating Rate Notes (FRNs).

Compound interest pays you interest on your principal; then, when it’s time to pay interest again, you’re paid interest on your principal and the previous interest that you earned. In other words, the interest that you’re paid adds to and becomes part of the principal that accrues interest during the next period. You have a continuously growing principal amount without having to make another deposit.

If your account supports subsequent deposits, you may choose to make regular deposits to go along with your automatically growing principal, you could accelerate the growth of funds in your accounts.

The power of compound interest is so attractive, Albert Einstein called it “The eighth wonder of the world!”

Our limit for ATM withdrawals is $1,000.00 per calendar day, and the ATM plus limit is $1,500. This is applicable on all our ATM and debit cards. These amounts may vary based on the ATM owner.

Availability of funds depends on your tier and the amount of the check. For deposits made to a checking account, $225.00 will be released the business day after the deposit is made; an additional $5,300.00 will be released on the second business day; and any remaining funds will be released on the seventh business day.*

- A deposit made by 5:00 p.m. CST Monday-Friday (excluding holidays) is considered to be the first day of that deposit.

- A deposit made AFTER 5:00 p.m. (or on a day we are not open) is considered deposited on the next business day we are open.

Please note that every day is considered a business day, except Saturdays, Sundays, and federal holidays, for determining the availability of your deposits.

*Holds may be extended per our exception hold policy. If an extended hold is placed on a deposited item, you will receive a Notice of Hold which includes the date the funds will be released.

Yes, when you are logged in to digital banking, you can place a stop payment on one or multiple check numbers, as well as an ACH. Please refer to your Fee Schedule for the applicable fee for each stop payment.

You can make payments or pay off your Personal Line-of-Credit via digital banking, visiting a branch or mailing your payment to Vantage. You can choose to make a minimum payment, pay a set dollar amount, or pay the balance in full automatically. Automatic payments are recommended but not required. The due date is on the 26 of each month.

It’s important to note that when you make a deposit to your Vantage checking account, we can’t automatically pay off your Personal Line-of-Credit balance unless you tell us to do so. You can always make additional payments via digital banking transfer or at any of our branch locations.Yes, if the ATM is in the CO-OP Network and accepts deposits.

You can start the process of getting a debit card for your Vantage checking account in digital banking or by calling us at 314.298.0055 or 800.522.6009 during business hours.

Debit card transaction limits depend on your account’s available funds and system parameters. You can always contact us ahead of time to make sure your transaction limit will accommodate a large transaction you’re anticipating.

Mortgage interest-rate movements are as hard to predict as the stock market and no one can really know for certain whether they’ll go up or down.

If you're perceiving that rates are on an upward trend, then you’ll want to consider locking in the rate as soon as you’re able. Before you decide to lock in a rate, make sure that your loan can close within the lock-in period. It won’t do any good to lock in your rate if you can’t close during the rate-lock period. If you’re purchasing a home, review your contract for the estimated closing date to help you choose the right rate-lock period. If you’re refinancing, in most cases, your loan could close within 45 days. However, if you have any secondary financing on the home that won’t be paid off, allow some extra time since we’ll need to contact that lender to get permission.

If you have multiple accounts with Vantage, you will need to register each of these accounts individually in digital banking.

For easier access to all of your accounts, consult our helpful Manage Multiple Accounts Guide or follow these steps to add additional accounts into your primary digital banking profile:

- Register each account you wish to add to your primary profile with a unique username.

- Log out of all profiles and log in to your primary profile.

- Click on the profile icon in the top right corner of the page and click Switch Accounts.

- On the Switch Accounts screen, click the Add Switch Account button.

- Log in with the credentials for the account you’d like to link to your primary profile.

- Once you’ve entered valid credentials, you’ll be prompted to complete additional security validation by requesting and entering a validation code.

- Once validated, the username will display on the Switch Accounts screen.

- Under your profile icon, when you select Other Profiles, you'll now have access to this other account on your primary profile.

- Repeat this process for any additional accounts you’d like to add to your primary profile.

7 to 10 business days.

Make your request on our CDs page and a Vantage representative will assist you. You can also call, start a chat on our website or stop by a branch to request to step up the rate on your CD.

An adjustable-rate mortgage (ARM) is a loan that offers a lower initial interest rate than most fixed-rate loans. The trade-off is that the interest rate can change periodically, usually in relation to an index, and the monthly payment will go up or down accordingly. You generally get a lower rate with an ARM in exchange for assuming more risk.

An ARM is the right mortgage choice for a variety of prospective homeowners, particularly if their income is likely to increase in the future or if they plan on being in the home for a short period of time.

Yes, as long as you also have a checking account, you can access your Regular Savings account by using your debit card at an ATM. If you only have a savings account, you would need to have an ATM card.

A mobile device with a working rear camera is needed to deposit checks directly into your digital banking account. You will only be able to make mobile deposits via the mobile app.

Nothing! There’s no charge to get your Vantage debit card, and there is no annual fee.

Yes. You can use thousands of ATMs worldwide. Just remember that sometimes there are charges associated with using ATMs belonging to other financial institutions. When using an ATM outside of the CO-OP network, you’ll incur a fee from Vantage, as well as any fee assessed by the ATM owner.

You can pay for goods and services anywhere Mastercard is accepted. Simply insert or tap your card at the terminal to complete the transaction. Depending on the store or the merchant, they may ask you to choose “debit or credit.” If you’re asked this question, we encourage you to choose “credit” as it costs your credit union less money to run transactions that way. Once the transaction is complete, you may need to sign a receipt.

Once you complete your request, you will see your new APY and applicable interest postings on your next statement.

If you are able to report that your debit card was lost or stolen before an unauthorized transaction takes place, you would not be liable. If you report within 48 hours, you’re only responsible for the first $50. The same loss rules apply for your Vantage credit card; however, it's important that you immediately report your debit card was lost or stolen so you aren’t responsible for more than $50. Reporting a card loss or theft within 60 days would result in a $500 liability limit.

The Federal Truth in Lending law requires that all financial institutions disclose the Annual Percentage Rate (APR) when they advertise a rate. The APR is designed to present the actual cost of obtaining financing, by requiring that some, but not all, closing fees are included in the APR calculation. These fees, in addition to the interest rate, determine the estimated cost of financing over the full term of the loan. Since most people do not keep the mortgage for the entire loan term, it may be misleading to spread the effect of some of these upfront costs over the entire loan term.

Also, the APR doesn’t always include all the closing fees. Fees for things like appraisals, title work, and document preparation are not included even though you’ll probably have to pay them.

For adjustable-rate mortgages, the APR can be even more confusing. Since no one knows exactly what market conditions will be in the future, assumptions must be made regarding future rate adjustments.

You can use the APR as a guideline to shop for loans, but you should not depend solely on the APR in choosing the loan program that’s best for you. Look at total fees, possible rate adjustments in the future if you’re comparing adjustable-rate mortgages, and consider the length of time that you plan on having the mortgage.

Don’t forget that the APR is an effective interest rate—not the actual interest rate. Your monthly payments will be based on the actual interest rate, the amount you borrow, and the term of your loan.You will be able to see payoff amounts on all loans except for mortgages and credit cards. Please call the credit union for mortgage or credit card payoff amounts.

No. You may only choose to step up your rate once during your CD’s three-year term. However, when your CD automatically renews for another three-year term, you’ll once again have one opportunity to step up your rate.

Yes. For your convenience, you can change your ATM card PIN by phone 24 hours a day, 7 days a week. You’ll need your card number, the last four digits of your Social Security Number and the phone number on file.

Cardholders with a U.S. phone number will need to call 866.985.2273 and follow the prompts.

Cardholders with an international phone number will need to call 531.262.5314 and follow the prompts.

Yes. In eligible countries, you can use either card at ATMs worldwide bearing the CO-OP Network, American Express, NYCE, PLUS, CIRRUS, VISA, Maestro, Discover or Mastercard logo.* Sometimes, it’s less expensive to use an ATM in a foreign country to get foreign currency than exchanging US currency for foreign currency at a foreign bank (due to currency exchange rates).

Some countries’ ATM networks only allow people to withdraw money from their checking accounts, so we encourage you to use a debit card. It’s recommended that members withdraw from a checking account instead of a savings account, as savings accounts may not be recognized on foreign ATM networks.

*A 1% foreign transaction fee based on the settlement amount is charged for each transaction. Conversion rates are subject to change. Other fees may apply.

We offer three types of overdraft protection, which are tapped in the following order: a Personal Line-of-Credit with overdraft feature selected, coverage from your Regular Savings, and coverage from our Discretionary Courtesy Pay service. If you overdraw your available checking account balance and have a linked Personal Line-of-Credit, funds are automatically transferred, subject to available credit limit, from the line-of-credit to cover your overdrafts for a nominal fee per transfer. You must apply and be approved for a Personal Line-of-Credit and, since it is a line-of-credit, finance charges apply to all advances.

If you don’t have a linked Personal Line-of-Credit or have exhausted your line-of-credit, funds are automatically transferred from your Regular Savings account to cover your overdrafts. Each automatic overdraft transfer from Regular Savings incurs a nominal fee. If the available balance in your Regular Savings account doesn’t cover your overdraft, our Discretionary Courtesy Pay service may cover overdrafts after first deducting our standard Courtesy Pay Fee for each transaction.

Our Discretionary Courtesy Pay service is not a loan or line-of-credit, is offered at our discretion, and may be removed at any time.

Yes. You can log in from any smartphone or mobile device, including Apple and Android devices, as long as your device is running on iOS 15 or higher or Android 12 or higher.