Find a Checking Account that Fits Your Life

Get in touch with us and become a member today!

Choose your debit card design!

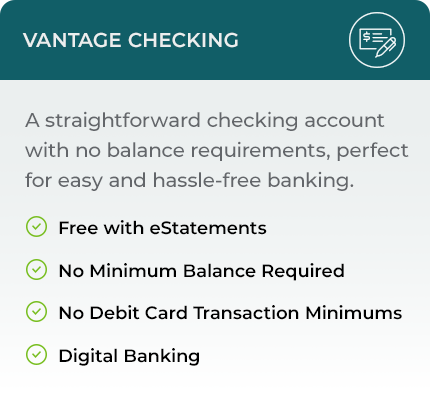

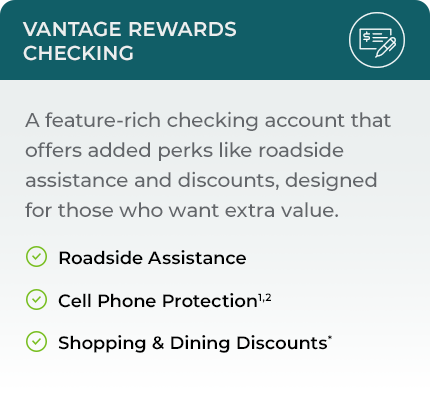

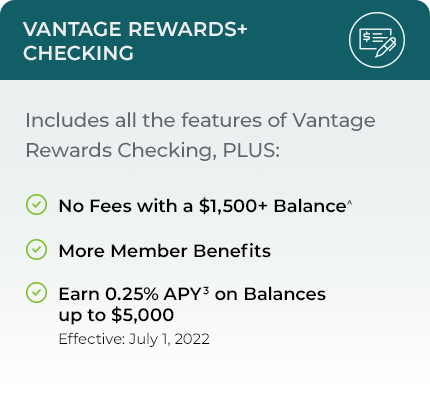

Discover the money-saving benefits of our checking accounts.

Legacy Checking—exclusively for educational employees

Education is our legacy—and yours. Founded by teachers, we're committed to serving members of the educational community on their financial journeys. Our Legacy Checking account is designed specifically for educational employees like you! It offers high value in both interest earnings and fee rebates—helping you reach your financial goals even faster.

Forget the apple. Get real rewards from your checking!

Legacy Checking Benefits:

- Interest-bearing (increases with debit card usage)**

- No minimum balance requirement

- No monthly maintenance fee

- NSF fee rebates (quarterly, by request)†

- 0% down educator mortgage††

- Legacy checking rates**:

0.10% APY3 | <20 debit card purchases (don't meet account qualifiers)

0.50% APY3 | 20-29 debit card purchases (meet account qualifiers)

1.25% APY3 | 30+ debit card purchases (meet account qualifiers)

....................

Interest paid on account balances up to $5,000

Rates effective: May 1, 2021

Overdraft Protection

Mistakes happen. You forget about an annual recurring payment or to transfer funds for a purchase that exceeds your balance. Vantage offers three types of overdraft protection that could help you avoid merchant fees or being declined at checkout in these situations.

1) Personal Line-of-Credit

If you overdraw your available checking account balance and have a linked Personal Line-of-Credit, funds automatically transfer, subject to available credit limit, from the line-of-credit to cover your overdrafts. You must apply and be approved for a Personal Line-of-Credit, and since it’s a line-of-credit, finance charges apply to all advances. You must also have the overdraft feature elected in order for the funds to transfer.

Apply for my Personal Line-of-Credit

2) Overdraft from Regular Savings

If you don’t have a linked Personal Line-of-Credit or have exhausted your line-of-credit, funds can be automatically transferred from your Regular Savings account to cover your overdrafts.

3) Courtesy Pay

If the available balance in your Regular Savings account will not cover your overdraft, our Discretionary Courtesy Pay service may cover overdrafts after first deducting our standard Courtesy Pay Fee for each transaction.

Our Discretionary Courtesy Pay service is not a loan or line-of-credit, is offered at our discretion and may be removed at any time. Learn more about extended overdraft coverage within digital banking.

Calculators

How Much Am I Spending?

Balance Your Check Book

Household Cash Flow Tracker

Spare Change

All members must maintain a membership share of $5 per primary account.

*Participating merchants on Vantage Checking Rewards are not sponsors of the program, are subject to change without notice, may not be available in all regions, and may choose to limit deals.

^Keep a $1,500 balance and we'll waive the $8 monthly fee.

1Subject to the terms and conditions detailed in the Guide to Benefits.

2Insurance products are: NOT A DEPOSIT. NOT FEDERALLY INSURED. NOT AN OBLIGATION OR GUARANTEED BY THE CREDIT UNION, ITS AFFILIATES, OR ANY GOVERNMENT AGENCY.

3All deposit rates disclosed as Annual Percentage Yield (APY). Rate may change after account opening. Fees could reduce earnings.

**Rate varies depending on debit card usage and meeting account qualifiers. You must have at least one (1) direct deposit, Automated Clearing House ("ACH") credit, remote deposit, or payroll deduction transaction of $250 or more post to your account per month; and enroll and receive electronic statements ("eStatements"). Alumni Club members are exempt from the eStatement requirement. Fees could reduce earnings.

†Each Legacy NSF Rebate must be requested by account holder and will be honored once per quarter.

††Subject to credit approval. Consult a Mortgage Solutions, LLC Mortgage Loan Officer for detailed requirements that apply.

Mortgage Solutions, LLC (NMLS #277481) dba Mortgage Solutions CU, LLC. Equal Housing Lender.