Discover Great Mortgage Options Today

Home buying solutions

Mortgage Solutions, LLC, a wholly owned subsidiary of Vantage Credit Union, can help you purchase your first home, move into a bigger home, downsize an empty nest, or even refinance your current residence. Qualified mortgage professionals are ready to answer all your questions and get you moved in with fast, easy—and most of all, affordable—mortgage services.

Buying a home can be stressful! Whether you’ve been through the process before or are gearing up for your first time, Vantage wants to simplify the process for you.

We have everything you need to make your home buying experience pain-free.

Start your mortgage application

Find out how much you can afford!

Choose the right mortgage loan for you:

- Conventional

- FHA

- VA

- Adjustable

- Fixed

- Jumbo fixed

- First-time homebuyer

- Educator

Educator Mortgage

Designed specifically for educators, this mortgage provides special benefits and lower rates to help those in the education field achieve their homeownership goals.

- No Down Payment Required: Buy your home with zero down payment, keeping your savings intact.

- Up to 100% Financing: Finance the full purchase price of your home without any initial out-of-pocket costs.

- Fast Actions: Move quickly when you find the right home without worrying about a down payment.

- Local Lender Focused on Educators: Get personalized services from a lender who understands your needs.

Contact Mortgage Solutions

Refinancing Your Home

If you own a home, you likely have a mortgage. Are there ever circumstances where you’d want or need to refinance your current mortgage? Of course!

Do you want to:

- Reduce your monthly mortgage payment by securing a lower interest rate

- Pay off your mortgage sooner (and reduce your total interest paid) by converting to a shorter term

- Make more manageable payments by extending your term

- Switch from an adjustable-rate mortgage (ARM)^ to a fixed-rate loan

- Eliminate mortgage insurance, if rising home values and loan payments have pushed your home equity above 20 percent

- Take advantage of your home’s equity by using money left over after paying your original mortgage for home renovations, large expenses, etc.

Refinancing might sound like a good option, but before you start the process, factor in the following. Refinancing isn’t free. It comes with costs, such as an origination fee, an appraisal, title insurance, taxes and other fees. And you need to check to see if your current lender will charge a prepayment penalty.

If you need help weighing the options, our experienced mortgage loan officers can discuss your situation and help with the solution that’s best for you!

Cash-Out Refinance

Purchasing a home is a big investment! Down the road, you may need repairs or wish the home renovation of your dreams. But, saving a large amount of money to complete those projects may be tough. Your home’s equity could be the key. It’s

called a cash-out refinance.

How could you use the funds from a cash-out refinance?

- Home improvement projects

- Investment purposes

- High-interest debt consolidation

- Education expenses

With a cash-out refinance, a new mortgage is taken out for more than your previous mortgage balance, and the difference is paid to you. Your lender will determine how much cash you can receive, based on standards such as your property’s loan-to-value

(LTV) ratio and your credit score.

Whether you want to pay down debt or renovate your kitchen, a cash-out refinance can be a powerful tool and can give you the money you need to move toward your goals.

What about a home equity loan or home equity line-of-credit? Yes, that’s another way to use the equity in your home. When considering your options, take into account what interest rates are available, the closing costs involved, and any potential refinance tax deductions available.

Adjustable-Rate Mortgage vs. Fixed-Rate Mortgage

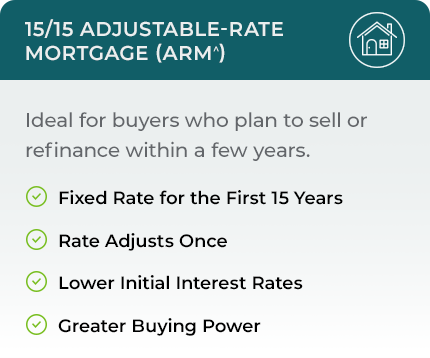

Are you shopping for your first home or looking to refinance? What’s an adjustable-rate mortgage (ARM)? Why choose that over a fixed-rate mortgage?

With an ARM, your interest rate remains fixed for a certain period—typically seven, 10 or 15 years—but then switches to a variable rate that adjusts every 12 months or so. With a fixed-rate mortgage, your interest rate remains the same for the life of your loan. It’s predictable and simple—but is it the right choice for you?

Does an ARM sound more complex? It doesn’t have to be—and it can offer certain advantages.

- Lower interest rate upfront. ARMs offer lower interest rates during their fixed period than fixed-rate mortgages.

- Qualification. ARMs are typically less risky for the lender’s perspective because they capitalize after the fixed period if interest rates increase.

- Flexibility. If you sell your home, or refinance, before the fixed-rate period ends, you’ll enjoy the lower rate and monthly payments.

In a raising-rate environment, an ARM mortgage is something to consider. It may help you afford a larger home, or a more desirable home, by maximizing your buying power. From fixed-rate mortgages to adjustable-rate mortgages—with other options in between—there’s a mortgage option to fit your needs.

Mortgage Solutions, LLC, is a wholly owned subsidiary of Members Resource LLC, a Credit Union Service Organization, a wholly owned subsidiary of Vantage Credit Union. Mortgage Solutions, LLC—NMLS #277481. Mortgage Solutions, LLC dba Mortgage Solutions CU, LLC. Equal Housing Lender

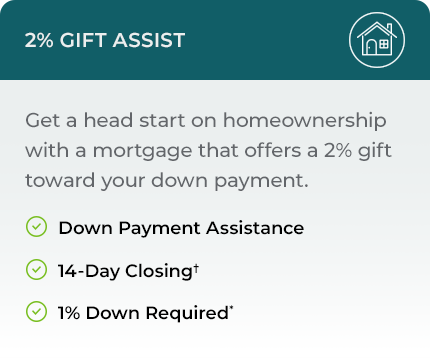

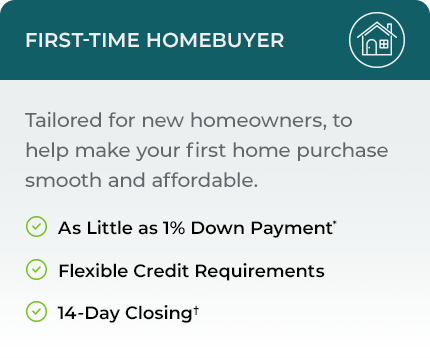

*Subject to approval and credit worthiness of applicant(s). This is assuming a purchase transaction, single-unit primary residence only, 97% LTV, and a 640 minimum FICO credit score. You cannot qualify if you make higher than 80% of the median income in the area in which you are looking to buy. For example, if you live in an area where the median income is $99,596, you can’t use more than $79,676.80 to qualify for this program ($99,596 x 0.8 = $79,676.80). There’s a $766,550 upper loan limit on this conventional option. The content presented here is provided for high-level information purposes only and not an offer to lend or extend credit. Not all loan products or terms and conditions apply. Products, rates and terms subject to change without notice.

^ARM loans are variable rate loans; interest rates and payments may increase after consummation. For example – 15/15ARM with a term of 30 years for $394,900, Initial Interest Rate of 4.875%, and an APR of 5.309%, your monthly payments for years 1 – 15 would be $2,089.84 and for years 16-30 monthly payments could be a minimum of $2,107 to a maximum of $2,683 (based on the current Index Plus Margin). Monthly payments do not include taxes and insurance and the actual payment obligation will be greater. Payments are based on a 60-day lock period with a scenario assuming borrower has excellent credit of 740 or higher. Subject to credit approval.

†Restrictions apply. View complete details.